Checkout Integration

Version: 6.6.4

Released: 2025/09/30

Introduction

This document describes the Checkout integration procedures between Checkout service and the website for e-commerce merchants.

To make your integration easier, please download collection and try it out:

Postman Collection

General Information

Checkout service is a fast and easy way to create a secure payment page. It allows collecting and submitting payments and sending them for processing.

To use the Checkout service on the site you have to perform integration. Checkout integration provides a set of APIs that allow customizing payment processing for the business. These protocols implement acquiring payments (purchases) using specific API interaction with the merchant websites.

The API requires request data as json string data and responds also with json string data.

⚠️ Pay attention

Checkout protocol requires requests to be sent using JSON formatting with the following content type:

Header: Content-Type: application/json

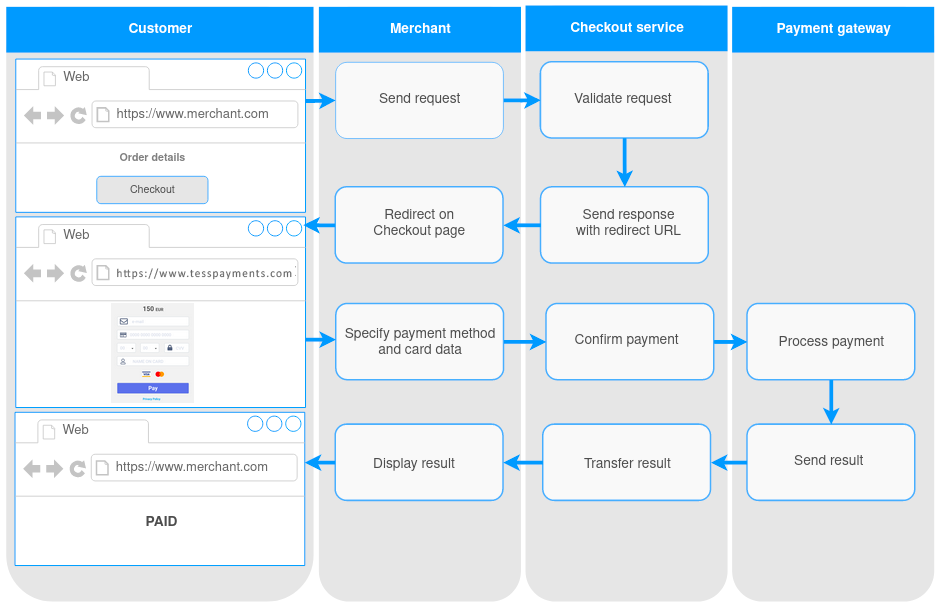

Checkout process

Checkout payment flow is shown below.

When a Customer wants to make a purchase on your site the following happens:

When a Customer wants to make a purchase on your site the following happens:

- Customer places an order and initiates payment on the site.

- Site confirms the order and sends the payment processing request to the Checkout system with information about the order, payment and hash.

- Checkout system validates the request and sends to the site the response with the redirect link.

- The site redirects the Customer on the Checkout page by redirect link.

- Customer selects the payment method, enters the payment data and confirms the payment. The payment method will be specifying automatically If only one method is available.

- The payment processes at Payment Gateway.

- Payment Gateway sends a callback to the site with the payment result.

- The payment result is shown to the Customer.

The payment could be declined in case of invalid data detection.

Protocol Mapping

It is necessary to check the existence of the protocol mapping before using the Checkout integration. Merchants can’t make payments if the CHECKOUT protocol is not mapped.

Customer return after payment

After completing the payment, the payer will be returned to the URL specified in the Authentication request in the "success_url" and "cancel_url" parameters. If you need to get additional parameters in the return URLs, you should configure it in the Protocol Mappings modules by enabling the "Return parameters" attribute. In that case, "success_url" and "cancel_url" will contain the following data:

| Parameter | Description |

|---|---|

payment_id | Payment ID Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

trans_id | Transaction ID Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

order_id | Order ID Example: order-1234 |

hash | Special signature, used to validate data. Addition in Signature section. Must be SHA1 of MD5 encoded string (uppercased): payment_public_id + order.number + order.amount + order.currency + order.description + merchant.pass |

⚠️ Pay attention

that for "cancel_url", the payer's return to the merchant with parameters is possible only after the decline has happened and the payer has closed the payment form (not the browser tab). If the payer closes the payment form without initiating the payment (pressing the PAY button), the redirection to "cancel_url" occurs without passing additional parameters.

Also it's possible to get Brand and Payment Method in the return URLs - you should configure it in the Protocol Mappings modules by enabling the "Return parameters" attribute and double-click or drag-and-drop to move items under Return additional parameters.

DMS mode

If you need to use Checkout integration to work with payments in DMS-mode (two-step payments), you should set the corresponding MID configuration in the admin panel. Specify DMS-mode for the MID attribute. In this case, the payment request will be processed as an authorization stage for DMS-mode. The capture requests will be generated and gathered in the queue. You could monitor and manage the capture request queue via the admin panel as well. For detailed information, please contact your administrator.

Checkout page description

Checkout page is shown to the Customer after a payment initiation. There are the fields to enter the payment data.

Definitions

| Variable | Description | Value |

|---|---|---|

{{CHECKOUT_HOST}} | Base URL for TESS Checkout | https://checkout.tesspayments.com |

Fields and Validation

The list of the fields on the Checkout page depends on the request parameters and the specified payment method.

Your customers will not see the fields if the acquirer does not need the information that is transmitted in them. For example, if an alternative payment method is specified, the card data is not displayed on the Checkout page.

As well, pay attention to the conditional fields such as e-mail or billing address. If the e-mail and billing address (data object) parameters are specified in the request, the Checkout page will not contain them.

Additional fields can also be displayed if a payment method is selected that requests additional data from the Customer.

The Checkout page has the fields validation. In case of the invalid data the error message will be shown and the field will be highlighted.

The list of the general fields and possible errors on the Checkout page is below:

| Fields | Type | Limitations | Error |

|---|---|---|---|

Card number | Integral | Lun algorithm, length 14-19 numbers | Invalid card number |

Expirу Date | Date | 2-2 numbers (in the format mm-yy), after today's date | The expiration date of card is expired and not valid. |

Security code | Integral | Up to 4 characters | Invalid security code |

Name on card | String | Up to 32 characters | The name on card field Must contain at least 2 words: first name and last name. Allowed special characters: hyphens, apostrophes, diacritics |

Country | List | 2-letters code | Country is required. Please enter a valid Country |

State/Region | String List - for USA, Canada, Australia, Japan, India | ||

City | String | Up to 32 characters | City is required. Please enter a valid City |

Address line | String | Up to 32 characters | Address line is required. Please enter a valid Address line |

Zip code | String | Up to 32 characters | Zip code is required. Please enter a valid Zip code |

Phone number | String | Up to 32 characters | Phone number is required. Please enter a valid Phone number |

Pre-routing

To make payment method choice easier for the Customer, pre-routing is provided on the Checkout.

The functionality allows you to set up matches in the admin panel via the Custom routing module, which will determine the list of payment methods suitable for the current payment.

This way, you can restrict your Customers from randomly choosing a payment method that is not available in their region, for example. This will help you to increase the number of successful payments and reduce the risk of declined transactions.

Note that if the Authentication request contains a list of the payment methods in the methods array, then the pre-routing configurations will be ignored.

Card data tokenization

For regular customers, we have made the payment page even more convenient and simple.

You can save the customer's card data so that they can reuse it for future payments.

To do this, you need to send the req_token = true parameter in the Authentication request. And then, in the callback, you will receive a card token.

Use the token when sending the next Authentication request and your client will see anonymized card details on the payment form, which will greatly simplify the payment process.

Web information

Checkout service gathers information about browser, which the Customer uses.

When the Customer is on the Checkout page, the service gets the data about the Customer's OS, browser, and browser language. That information is sent to the acquirer in some cases.

iFrame option

You can use iFrame option to show Checkout page on your domain. All you need is just to past in the code redirect url received in the response to the Authentication request.

Please follow the example:

<iframe src=redirect_url height="600" width="300"></iframe>

Note that screen size can be adjusted according to your requirements.

Important: cross-domain requests are prohibited by security policy of our service.

⚠️ Pay attention

By adding our Checkout Payment Page to the iframe on your site, ensure you ALLOW ACCESS TO COOKIE STORAGE.

This is required to avoid issues when redirecting the payer back to your site, such as after 3DS authentication. If you prohibit the storage of third-party data in your cookies, you will prevent the identification of the payer after returning from 3DS. This can cause interruptions in the payment session.

Page Customization

The administration service provides the ability to stylize the Checkout page in accordance with the preferences of the merchant. The action is available for the authorized users only. To customize the payment page you need:

- Click the “Configuration → Branding” item on the menu bar. The settings are displayed in the work area.

- Select a page template to make changes.

- Change the settings:

- login icon selection;

- color selection for the following items:

- heading;

- background;

- buttons;

- Click the “Submit” button to apply the settings. The selected settings will be displayed to the Customers on the Checkout page.

Authentication request parameters

The merchant submits an authorization request and as a result of successful response receives the redirect_url - link on the Checkout page.

/api/v1/session

The authentication performs when the payment is initiated.

You need to send an authentication POST request in JSON format on Checkout form URL (CHECKOUT_URL) to start checkout process for the Customers. As a result of the authentication request you will receive the following:

- An authentication session is created with a unique identifier (Session ID). The session expires after one hour.

- A link is generated to redirect to the Checkout page: one link corresponds to one payment. The link becomes invalid after a successful payment. The authentication request parameters are below.

If DMS-mode (two-stages payment) is available, after successful authentication it is necessary to capture. The capture would be performed automatically according to the settings or you can do it manually in the admin portal.

Request Parameters

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

merchant_key | String | Required | Key for Merchant identification Example: xxxxx-xxxxx-xxxxx |

operation | String | Required | Defines a payment transaction Possible values: purchase, debit, transfer, credit Send the “purchase” value so that the payment page for sale initiation will be shown to the customer. Send the “debit” value so that the payment page for debit initiation will be shown to the customer. Send the “transfer” value so that the payment page for transfer initiation will be shown to the customer. Send the “credit” value so that the payment page for credit initiation will be shown to the customer. Example: purchase |

methods | Array | Optional | An array of payment methods. Limits the available methods on the Checkout page (the list of the possible values in the Payment methods section). In the case of parameter absence, the pre-routing rules are applied. If pre-routing rules are not configured, all available payment methods are displayed. Condition: for purchase operation only For purchase and debit operations. Example: card, paypal, googlepay |

channel_id | String | Optional max: 16 | This parameter is used to direct payments to a specific sub-account (channel). If the channel is configured for Merchant Mapping, the system matches the value with the corresponding channel_id value in the request to route the payment. Note: The channel must correspond to one of the payment methods (brands) listed in the methods array. If the methods array is empty, only the channel_id will affect the selection of the payment method (Merchant Mapping). |

session_expiry | Integer | Optional Values from 1 to 720 min | Session expiration time in minutes. Default value = 60. Could not be zero. Example: 60 |

success_url | String | Required Valid URL max: 1024 | URL to redirect the Customer in case of the successful payment Example: https://example.domain.com/success The return of additional parameters can be configured for success_url. See the “Customer return after payment” section for details. |

cancel_url | String | Optional Valid URL min: 0 max: 1024 | URL to return Customer in case of a payment cancellation (“Close” button on the Checkout page). The logic of redirection on “cancel_url” could be configured in the admin panel (Configuration -> Protocol Mappings section): use the “Maximum count declines” field to set the payment failed attempts quantity before redirection. For example, if the field value is set to "1", then after the first declined attempt, a payer will be redirected to "cancel_url." Example: https://example.domain.com/cancel The return of additional parameters can be configured for cancel_url. See the “Customer return after payment” section for details. |

expiry_url | String | Optional Valid URL min: 0 max: 1024 | URL where the payer will be redirected in case of session expiration **Example: **https://example.domain.com/expiry |

error_url | String | Optional Valid URL min: 0 max: 1024 | URL to return Customer in case of undefined transaction status. If the URL is not specified, the cancel_url is used for redirection. **Example: **https://example.domain.com/errorurl |

url_target | String | Optional Possible values: _self, _parent, _top.Find the result of applying the values in the HTML standard description (Browsing context names) | Name of, or keyword for a browsing context where Customer should be returned according to HTML specification. Example: _parent |

req_token | Boolean | Optional default - false | Special attribute pointing for further tokenization If the card_token is specified, req_token will be ignored.For purchase and debit operations. Example: false |

card_token | Array of Strings | Optional String 64 characters | Credit card token value For purchase and debit operations. Example: f5d6a0ab6fcfb6487a39e2256e50fff3c95aaa97 |

recurring_init | Boolean | Optional default - false | Initialization of the transaction with possible following recurring Only for purchase operation Example: true |

schedule_id | String | Optional It s available when recurring_init = true | Schedule ID for recurring payments Only for purchase operation Example: 57fddecf-17b9-4d38-9320-a670f0c29ec0 |

vat_calc | Boolean | Conditional true or false default - false | Indicates the need of calculation for the VAT amount • 'true' - if VAT calculation needed • 'false' - if VAT should not be calculated for current payment. Only for purchase operation Example: false |

hash | String | Required | Special signature to validate your request to Payment Platform Addition in Signature section. Example: Must be SHA1 of MD5 encoded string (uppercased): order_number + order_amount + order_currency + order_description + password |

| order | Object | Required | Information about an order |

number | String | Required max: 255 [a-z A-Z 0-9 -!"#$%&'()*+,./:;&@] | Order ID Example: order-1234 |

amount | String | Required Greater then 0 [0-9] max: 255 | Format depends on currency. Send Integer type value for currencies with zero-exponent. Example: 1000 Send Float type value for currencies with exponents 2, 3, 4. Format for 2-exponent currencies: XX.XX Example: 100.99 Pay attention that currencies 'UGX', 'JPY', 'KRW', 'CLP' must be send in the format XX.XX, with the zeros after comma. Example: 100.00 Format for 3-exponent currencies: XXX.XXX Example: 100.999. Format for 4-exponent currencies: XXX.XXXX Example: 100.9999 For transfer operation: Send amount if you want to show default value in the amount field on the Checkout. The customers can change the value manually on the payment form.Send "-1" value if you want to show empty amount field on the Checkout so that the Customers could enter the value manually. |

description | String | Required min: 2 max: 1024 [a-z A-Z 0-9 !"#$%&'()*+,./:;&@] | Product name Example: Very important gift - # 9 |

| customer | Object | Conditional | Customer's information. Send an object if a payment method needs |

name | String | Conditional min: 2 max: 200 Latin basic [a-z A-Z] | Customer's name Condition: If the parameter is NOT specified in the request, then it will be displayed on the Checkout page (if a payment method needs) - the "Cardholder" field Example: John Doe |

email | String | Conditional min: 2 max: 255 email format | Customer's email address Condition: If the parameter is NOT specified in the request, then it will be displayed on the Checkout page (if a payment method needs) - the "E-mail" field Example: [email protected](url) |

birth_date | String | Conditional format: yyyy-mm-dd ISO 8601 | Payer's birth date Example: 1970-02-17 |

| billing_address | Object | Conditional | Billing address information. Condition: If the object or some object's parameters are NOT specified in the request, then it will be displayed on the Checkout page (if a payment method needs) |

country | String | Conditional 2 characters (alpha-2 code) ISO 3166-1 | Billing country Example: QA |

state | String | Optional min: 2 max: 32 [a-z A-Z] It is 2-letters code for USA, Canada, Australia, Japan, India | Billing state address Example: CA |

city | String | Conditional min: 2 max: 40 [a-z A-Z] | Billing city Example: Doha |

district | String | Optional min: 2 max: 32 [a-z A-Z 0-9 - space] | City district Example: Beverlywood |

address | String | Conditional min: 2 max: 32 [a-z A-Z 0-9] | Billing address Example: Moor Building |

house_number | String | Optional min: 1 max: 9 [a-z A-Z 0-9/ - space] | House number Example: 17/2 |

zip | String | Conditional min: 2 max: 10 [a-z A-Z 0-9] | Billing zip code Example: 123456, MK77 |

phone | String | Conditional min: 1 max: 32 [0-9 + () -] | Customer phone number Example: 347771112233 |

| payee | Object | Conditional | Payee's information. Specify additional information about Payee for transfer or credit operation if it is required by payment provider. |

name | String | Required min: 2 max: 32 Latin basic [a-z A-Z] | Customer's name. Example: John Doe |

email | String | Conditional email format | Customer's email address. Example: [email protected] |

| payee_billing_address | Object | Conditional | Billing address information for Payee. |

country | String | Conditional 2 characters (alpha-2 code) ISO 3166-1 | Billing country Example: QA |

state | String | Optional min: 2 max: 32 [a-z A-Z] It is 2-letters code for USA, Canada, Australia, Japan, India | Billing state address Example: CA |

city | String | Conditional min: 2 max: 40 [a-z A-Z] | Billing city Example: Doha |

district | String | Optional min: 2 max: 32 [a-z A-Z 0-9 - space] | City district Example: Beverlywood |

address | String | Conditional min: 2 max: 32 [a-z A-Z 0-9] | Billing address Example: Moor Building |

house_number | String | Optional min: 1 max: 9 [a-z A-Z 0-9/ - space] | House number Example: 17/2 |

zip | String | Conditional min: 2 max: 10 [a-z A-Z 0-9] | Billing zip code Example: 123456, MK77 |

phone | String | Conditional min: 1 max: 32 [0-9 + () -] | Customer phone number Example: 347771112233 |

network | String | Optional max: 50 | Specified value will be shown. You can use an arbitrary value or select one from the following. Example: • ERC20 • TRC20 • BEP20 • BEP2 • OMNI • solana • polygon |

| parameters | Object | Optional | Extra-parameters required for specific payment method Example: "parameters": { "payment_method": { "param1":"val1", "param2":"val2" } } |

| custom_data | Object | Optional | Custom data This block can contain arbitrary data, which will be returned in the callback. Example: “custom_data”: {“param1”:”value1”, “param2”:”value2”, “param3”:”value3”} |

If a Merchant prefers to use a custom payment form, they must specify a unique identifier to be included in the Checkout Authentication Request, which will ensure that this payment form is displayed to customers.

"form_id": "xxxxx-xxxxx-xxxxx"}

More information can be found on the SDK CHECKOUT page.

Authentication (OK)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/session' \

--header 'Content-Type: application/json' \

--data-raw '{

"merchant_key": "xxxxx-xxxxx-xxxxx",

"operation": "purchase",

"methods": [

"card",

"method1"

],

"parameters": {

"card": {

"param1": "val-1",

"param2": "val-2"

},

"method1": {

"param1": "val-3",

"param2": "val-4"

}

},

"session_expiry": 60,

"order": {

"number": "order-1234",

"amount": "0.19",

"currency": "QAR",

"description": "Important gift"

},

"cancel_url": "https://example.domain.com/cancel",

"success_url": "https://example.domain.com/success",

"expiry_url": "https://example.domain.com/expiry",

"url_target": "_blank",

"customer": {

"name": "John Doe",

"email": "[email protected]"

},

"billing_address": {

"country": "QA",

"state": "CA",

"city": "Doha",

"district": "Beverlywood",

"address": "Moor Building 35274",

"house_number": "17/2",

"zip": "123456",

"phone": "347771112233"

},

"card_token": [

"f5d6a0ab6fcfb6487a39e2256e50fff3c95aaa97075ee5e539bb662fceff4dc1"

],

"req_token": true,

"recurring_init": true,

"schedule_id": "9d0f5cc4-f07b-11ec-abf4-0242ac120006",

"hash": "{{session_hash}}"

}

'

Debit Operation (OK)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/session' \

--header 'Content-Type: application/json' \

--data-raw '{

"merchant_key": "xxxxx-xxxxx-xxxxx",

"operation": "debit",

"methods": [

"card"

],

"parameters": {

"card": {

"param1": "val-1",

"param2": "val-2"

},

"session_expiry": 60,

"order": {

"number": "order-1234",

"amount": "0.19",

"currency": "QAR",

"description": "Important gift"

},

"cancel_url": "https://example.domain.com/cancel",

"success_url": "https://example.domain.com/success",

"expiry_url": "https://example.domain.com/expiry",

"url_target": "_blank",

"customer": {

"name": "John Doe",

"email": "[email protected]"

},

"billing_address": {

"country": "QA",

"state": "CA",

"city": "Doha",

"district": "Beverlywood",

"address": "Moor Building 35274",

"house_number": "17/2",

"zip": "123456",

"phone": "347771112233"

},

"card_token": [

"f5d6a0ab6fcfb6487a39e2256e50fff3c95aaa97075ee5e539bb662fceff4dc1"

],

"req_token": true,

"hash": "{{session_hash}}"

}

}

'

Transfer Operation (OK)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/session' \

--header 'Content-Type: application/json' \

--data-raw '{

"merchant_key":"xxxxx-xxxxx-xxxxx",

"operation":"transfer",

"order":{

"number":"order-1234",

"amount": "100.55",

"currency":"QAR",

"description":"Important gift"

},

"cancel_url":"https://example.com/cancel",

"success_url":"https://example.com/success",

"customer":{

"name":"John Doe",

"email":"[email protected]"

},

"payee": {

"name":"John Doe",

"email":"[email protected]"

},

"billing_address":{

"country":"QA",

"state":"California",

"city":"Doha",

"address":"Moor Building 35274 State ST Fremont. U.S.A",

"zip":"94538",

"phone":"0987654321",

"district":"Brentwood",

"house_number":"123"

},

"payee_billing_address":{

"country":"QA",

"state":"New York",

"city":"New York",

"address":"Moor Building 35274 State ST Fremont. U.S.A",

"zip":"94538",

"phone":"0987654321",

"district":"Brentwood",

"house_number":"123"

},

"hash":"{{session_hash}}"

}

'

Credit Operation (OK)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/session' \

--header 'Content-Type: application/json' \

--data-raw '{

"merchant_key": "xxxxx-xxxxx-xxxxx",

"operation": "credit",

"methods": [

"airtel"

],

"order": {

"number": "order-1234",

"amount": "100.55",

"currency": "QAR",

"description": "Credit"

},

"cancel_url": "https://example.com/cancel",

"success_url": "https://example.com/success",

"payee_billing_address": {

"country": "QA",

"phone": "347771112255"

},

"hash": "{{session_hash}}"

}

'

Example Response (OK)

{

"redirect_url": "{{CHECKOUT_HOST}/auth/ZXlKMGVYQWlPaUpLVjFRaUxDSmhiR2NpT2lKU1V6STFOaUo5LmV5SnBZWFFpT2pFMU9UWXhPRFl6T0Rnc0ltcDBhU0k2SWpGbE5qTTNObVZoTFdRek1HUXRNVEZsWVMxaE16QXlMVEF5TkRKak1HRTRNekF4TWlJc0ltVjRjQ0k2TVRVNU5qRTRPVGs0T0gwLm9CMmVhdlRtTU5DMXFTajlDVFlqQ0dOMDlHdUs1NXRkQTVpWFR3d2F2cWR0cEpEU2NRWWFaT3Z5dmJSVjJUSFNUVlFlS0NUX3pRdFNycDlKS1M4X0pqUzRMclM5MnUyNXRfSHNGa1FUQ0VOdGtadHQtaGxONERYdVhkLTU5cEhKLUN1RXBqSmZ4UDZEQXhFaVAxWEpRZDlyQldNa1RQVDdGZm1ac0g4LTM5YnV6LTI3MWxKMndkekdvSGJYa0NKVnNTNFJldGxrbno2U3dGd3ZFMW5KNDhwYTBGMDNLWjBpNnhpRFVPR3p2U0ZKdGZfMndDTTdzTTdsemc1TlBmSDl0Q0RKQmZEaG1hUmJCRmR6RlZMZlJncG5tMzB3VWpTMGMxbmt6SkkxOGJTd2Z6Z0hfZFpnc1cyUFhCM2ZLdG9pWDJXeFRsQzlxR204QTRYVm9EQy1mOWxvRHlMd0F5eV9xY3JrWmNuQTJVSjk5Zl91c0cwODZKUlBTT0I4VHVRZndSTzUxSEN2bEU2TXdFYzVYRmtnYjBleEZRcXdpNGE4S2RlWV9HX3ZQam42bnpZODdtVzFINlpQMjJ0dzVzazYtUENMeHdvNXctUmFBWC1mYVVhcEVHTzFLZkVHbndaQWZBZVNyc3U4MV9XQUFJMlN5RUxGWi1IU1lXMUZLWFgybzNNeF93Ty1DS3FLTWZsUTV1cGc2eDAybzhsbFhoeGJlVmVIOWlkMHgzYldRWE9vWk5hWm1MeVpJMmJsT2dtVDV0cHR4NHNQNDNqT0NtYW1sdkxyUkZvQmxCNTJ4V0RUQTBZQnhBLW5meUxCRHRJN0dPaVRWQjJ5cWd1Z1lBdGRfbWFQN2x2YTJpbVJWaHhxT0R5SlRiZThxcDdhWkw4bkJvTHZocnZDOHlv"

}

Authentication request possible errors

Parameter Values Validation

Checkout service validates the request parameters and sends the error responses in case of an invalid data detection.

Example Request - Validation (bad)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/session' \

--header 'Content-Type: application/json' \

--data-raw '{

"merchant_key":"xxxxx-xxxxx-xxxxx",

"operation":"credit",

"methods":[ "" ],

"order":{

"number":"",

"amount": "1.2",

"currency":"Dollar",

"description":""

},

"cancel_url":"1.com",

"success_url":"",

"customer":{

"name":"John Doe",

"email":"[email protected]"

},

"recurring_init": "true",

"hash":"728d13b95cf2b6b3ee04b20dc2fc9889ffff1cf4"

}

'

Example Response - 400 Bad Request

{

"error_code": 0,

"error_message": "Request data is invalid.",

"errors": [

{

"error_code": 100000,

"error_message": "operation: The value you selected is not a valid choice."

},

{

"error_code": 100000,

"error_message": "methods: This value should not be blank."

},

{

"error_code": 100000,

"error_message": "order.number: This value should not be blank."

},

{

"error_code": 100000,

"error_message": "order.amount: This value should be greater than 0."

},

{

"error_code": 100000,

"error_message": "order.currency: This value is not valid."

},

{

"error_code": 100000,

"error_message": "order.description: This value should not be blank."

},

{

"error_code": 100000,

"error_message": "cancel_url: This value is not a valid URL."

},

{

"error_code": 100000,

"error_message": "success_url: This value should not be blank."

}

]

}

Hash Validation

The Checkout service always performs hash validation.

The request will be rejected if the hash value is invalid.

Example Request - Hash Validation

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/session' \

--header 'Content-Type: application/json' \

--data-raw '{

"merchant_key":"xxxxx-xxxxx-xxxxx",

"operation":"purchase",

"methods":[

"card"

],

"order":{

"number":"order-1234",

"amount": "0.19",

"currency":"QAR",

"description":"Important gift"

},

"cancel_url":"https://example.com/cancel",

"success_url":"https://example.com/success",

"customer":{

"name":"John Doe"

},

"hash":"wrong hash"

}

'

Example Response - Hash error

{

"error_code": 0,

"error_message": "Request data is invalid.",

"errors": [

{

"error_code": 100000,

"error_message": "hash: Hash is not valid."

}

]

}

Callback Notification

Checkout service sends the callback on the merchant notification_URL as a result of an operation.

You can receive the callback for the next operation types:

- SALE

- 3DS

- REDIRECT

- CAPTURE

- REFUND

- VOID

- RECURRING

- CHARGEBACK

- DEBIT

- TRANSFER

⚠️ Pay attention

Note that the notification URL may be temporarily blocked due to consistently receiving timeouts in response to the callback. If five timeouts accumulate within five minutes for a merchant’s notification URL, it will be blocked for 15 minutes. During this block, all merchants associated with the URL will not receive notifications. The block automatically lifts after 15 minutes. Additionally, it is possible to manually unblock the URL through the admin panel by navigating to Configuration → Merchants → Edit Merchant. In this case, the block will be removed immediately. The timeout counter resets if a callback response is successfully processed. For instance, if there are four timeouts within five minutes but a successful response on the sixth minute, the counter resets.

⚠️ Pay attention

In the case of cascading, the logic for sending callbacks differs.

If cascading is triggered for the order, in general case you will receive only callback for the last payment attempt, where the final status of the order (settled or declined) is determined. In the particular cases, you will receive callback for the first payment attempt with the data for customer’s redirection if it is required by payment provider. Callbacks for intermediate attempts (between the first decline and the last payment attempt) are not sent.

List of Possible Transaction Statuses

The possible statuses are listed below:

| Transaction Status | Operation type | Description |

|---|---|---|

| SUCCESS | sale, 3ds, redirect, capture, refund, void, recurring, chargeback, debit, transfer | Transaction is successfully completed in Payment Platform |

| FAIL | sale, capture, refund, void, recurring, debit, transfer | Transaction has the errors and is not validated by Payment Platform |

| WAITING | sale, capture, refund, void, recurring, debit, transfer | Transaction is being processed by Payment Platform |

| UNDEFINED | sale, 3ds, redirect, capture, refund, void, recurring, debit, transfer | Uncertain payment status due to problems interacting with the payment provider |

⚠️ Pay attention

that successful transaction does not mean successful final status for the payment.

Example for SMS mode (1-step paments) only:

Payment is successfully completed if transaction hasstatus= success andtype= sale. Payment is not completed if transaction hasstatus= success andtype= redirect.

Callback parameters

Callback is HTTP POST request whcih includes the following data:

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

id | String | Required | Transaction ID Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

order_number | String | Required Up to 255 characters | Order ID Example: order-1234 |

order_amount | Float | Required Format: XX.XX, without leading zeroes | Product price Example: 0.19 |

order_currency | String | Required Up to 6 characters | Currency code. 3-characters for fiat currencies and from 3 to 6 characters |

order_description | String | Required Up to 1024 characters | Product description Example: Important gift |

order_status | String | Required Up to 20 characters | Payment status: prepare, settled, pending, 3ds, redirect, decline, refund, reversal, chargeback Example: 3ds |

type | String | Required Up to 36 characters | Operation type: sale, 3ds, redirect, capture, refund, void, chargeback, debit, transfer Example: sale |

status | String | Required Up to 20 characters | Transaction status: success, fail, waiting, undefined Example: success |

reason | String | Optional Up to 1024 characters | Decline or error reason. It displays only if the transaction has FAIL status. Example: The operation was rejected. Please contact the site support |

payee_name | String | Optional | Payee's first and last name Returns only for transfer operation Example: John Rickher |

payee_email | String | Optional | Payee's e-mail Returns only for transfer operation Example: [email protected] |

payee_country | String | Optional Up to 3 characters | Payee's country Returns only for transfer operation Example: QA |

payee_state | String | Optional Up to 32 characters | Payee's state Returns only for transfer operation Example: California |

payee_city | String | Optional Up to 32 characters | Payee's city Returns only for transfer operation Example: Doha |

payee_address | String | Optional Up to 32 characters | Payee's city Returns only for transfer operation Example: 123 Sample Street |

connector_name * | String | Optional | Connector's name (Payment Gateway). Example: MyPaymentConnector |

rrn * | String | Optional | Retrieval Reference Number value from the acquirer system. Example: 123456789012 |

arn * | String | Optional | Acquirer Reference Number. Example: 74046106207016278609311 |

approval_code * | String | Optional | Approval code value from the acquirer system. Example: 123456 |

brand * | String | Optional | Used brand. Example: visa |

Payment method * | String | Optional | Used Payment Method. Example: visa |

gateway_id * | String | Optional | Gateway ID – transaction identifier provided by payment gateway. Example: 123-456-789 |

extra_gateway_id * | String | Optional | Extra Gateway ID – additional transaction identifier provided by payment gateway. Example: abc123 |

merchant_name* | String | Optional | Merchant Name Example: TESTMerchantName |

mid_name * | String | Optional | MID Name Example: TESTMIDName |

issuer_country * | String | Optional | Issuer Country Example: DE |

issuer_bank * | String | Optional | Issuer Bank Example: Deutsche Bank |

card | String | Optional Format: ХХХХХХ******ХХХХ | Card number mask Example: 411111******1111 |

card_expiration_date | String | Optional | Card expiration date Example: 12/2022 |

payee_card | String | Optional | Payee card number mask Returns only for transfer operation Example: 411111******1111 |

card_token | String | Optional | Card token. It is available if the parameter req_token was enabledIt is available only for purchase operation Example: VjFRaUxDSmhiR2NpT2lKU1V6STFO |

customer_name | String | Optional | Customer's first and last name Example: John Rickher |

customer_email | String | Optional Format: [email protected] | Customer's email address Example: [email protected] |

customer_country | String | Optional Up to 3 characters | Customer's country Example: QA |

customer_state | String | Optional Up to 32 characters | Customer's state Example: California |

customer_city | String | Optional | Customer's city Example: Doha |

customer_address | String | Optional Up to 32 characters | Customer's address Example: 123 Sample Street |

customer_ip | String | Required | Customer's IP Example: 255.41.45.57 |

date | Date | Optional Format: YYYY-MM-DD hh:mm:ss | Transaction date Example: 2020-08-05 07:41:10 |

recurring_init_trans_id | String | Optional | Reference to the first transaction that initializes the recurring (provided if recurring was initialized) It is available only for purchase operation Example: dc66cdd8-d702-11ea-9a2f-0242c0a87099 |

recurring_token | String | Optional | Recurring token (provided if recurring was initialized) Example: e5f60b35485e |

schedule_id | String | Optional | It is available if schedule is used for recurring sale It is available only for purchase operation |

exchange_rate | Decimal | Optional | Rate used to make exchange. It returns if the currency exchange has been applied for the payment. |

exchange_rate_base | Decimal | Optional | The rate used in the double conversion to convert the original currency to the base currency. It returns if the currency exchange has been applied for the payment. |

exchange_currency | Dictionary | Optional | Original currency. It returns if the currency exchange has been applied for the payment. |

exchange_amount | Integer | Optional | Original amount. It returns if the currency exchange has been applied for the payment. |

vat_amount | Float | Optional Format: XX.XX, without leading zeroes | Product VAT Returns if VAT has been calculated for the payment. It is available only for purchase operation Example: 0.09 |

digital_wallet | String | Optional | Wallet provider: googlepay, applepay. It is returned if digital wallets were used for card payment creation. Example: googlepay |

pan_type | String | Optional | It refers to digital payments, such as Apple Pay and Google Pay, and the card numbers returned as a result of payment token decryption: DPAN (Digital Primary Account Number) and FPAN (Funding Primary Account Number). Possible values: dpan, fpan. It is returned if digital wallets were used in card payment creation. Example: dpan |

| custom_data | Object | Optional | Custom data This block duplicates the arbitrary parameters that were passed in the payment request Example: “custom_data”: {“param1”:”value1”, “param2”:”value2”, “param3”:”value3”} |

extended_data* | String | Optional | Contains custom key-value data (see “Add Extended Data to Callback” block in the Configurations -> Protocol Mappings section). Example: extended_data%5Buser_id%5D=CUST456 |

hash | String | Required | Special signature, used to validate callback Addition in Signature section. Example: Must be SHA1 of MD5 encoded string (uppercased): payment_public_id + order.number + order.amount + order.currency + order.description + merchant.pass |

* The parameters are included if the appropriate setup is configured in the admin panel (see “Add Extended Data to Callback” block in the Configurations -> Protocol Mappings section).

Examples

Callback examples

Merchant successful sale callback

id=f0a51dfa-fc43-11ec-8128-0242ac120004&

order_number=order-1234&

order_amount=3.01&

order_currency=QAR&

order_description=bloodline&

order_status=settled&

type=sale&

status=success&

card=411111****1111&

card_expiration_date=12/2022&

connector_name=MyPaymentConnector&

arn=74046106207016278609311

rrn=789012345678&

approval_code=123456&

schedule_id=4e46866c-f84b-11ec-8b4c-0242ac120007&

recurring_init_trans_id=f0a51dfa-fc43-11ec-8128-0242ac120004&

recurring_token=f0e24964-fc43-11ec-a7e0-0242ac120004&

date=2022-07-05 09:22:09&

hash=6d8d440e25bdfc5288616ce567496948d2562852&

gateway_id=123-456-789&

extra_gateway_id=abc123&

merchant_name=TESTMerchantName&

mid_name=TESTMIDName&

issuer_country=DE&

issuer_bank=Deutsche Bank&

customer_name=D D&

[email protected]&

customer_country=QA&

customer_state=California&

customer_city=Doha&

customer_address=Moor Building 35274 State ST Fremont. U.S.A&

customer_ip=10.10.10.2&

exchange_rate_base=26.19&

exchange_rate=6.47&

extended_data%5Buser_id%5D=CUST456

exchange_currency=UAH&

exchange_amount=100.00

Merchant successful debit callback

id=f0a51dfa-fc43-11ec-8128-0242ac120004&

order_number=order-1234&

order_amount=3.01&

order_currency=QAR&

order_description=bloodline&

order_status=settled&

type=debit&

status=success&

card=411111****1111&

card_expiration_date=12/2022&

date=2022-07-05+09:22:09&

hash=6d8d440e25bdfc5288616ce567496948d2562852&

customer_name=D D&

[email protected]&

customer_country=QA&

customer_state=California&

customer_city=Doha&

customer_address=Moor Building 35274 State ST Fremont. U.S.A&

customer_ip=10.10.10.2

extended_data%5Buser_id%5D=CUST456

Merchant successful refund callback

id=f0a51dfa-fc43-11ec-8128-0242ac120004&

order_number=order-1234&

order_amount=3.01&

order_currency=QAR&

order_description=bloodline&

order_status=settled&

type=refund&

status=success&

card=411111****1111&

card_expiration_date=12/2022&

schedule_id=4e46866c-f84b-11ec-8b4c-0242ac120007&

date=2022-07-05+09:28:01&

hash=6d8d440e25bdfc5288616ce567496948d2562852&

customer_name=D D&

[email protected]&

customer_country=QA&

customer_state=California&

customer_city=Doha&

customer_address=Moor Building 35274 State ST Fremont. U.S.A&

customer_ip=10.10.10.2

extended_data%5Buser_id%5D=CUST456

Merchant successful transfer callback

id=f0a51dfa-fc43-11ec-8128-0242ac120004&

order_number=order-1234&

order_amount=3.01&

order_currency=QAR&

order_description=bloodline&

order_status=settled&

type=transfer&

status=success&card=411111****1111&

card_expiration_date=12/2022&

payee_card=422222****2222&

date=2022-07-05+09:22:09&

hash=6d8d440e25bdfc5288616ce567496948d2562852&

customer_name=D D&

[email protected]&

customer_country=QA&

customer_state=California&

customer_city=Doha&

customer_address=Moor Building 35275&

customer_ip=10.10.10.2&

payee_name=D D&

[email protected]&

payee_country=QA&

payee_state=California&

payee_city=Doha&payee_address=Moor Building 35274 State ST Fremont. U.S.A

Merchant unsuccessful sale callback

id=1f34f446-fc45-11ec-a50f-0242ac120004&

order_number=order-1234&

order_amount=3.01&

order_currency=QAR&

order_description=bloodline&

order_status=decline&

type=sale&

status=fail&

card=411111****1111&

card_expiration_date=12/2022&

reason=Declined by processing.&

date=2022-07-05+09:30:35&

hash=7f15d178e9b2c8507dea57f8ed1efddb9573fa6b&

customer_name=D D&

[email protected]&

customer_country=QA&

customer_state=California&

customer_city=Doha&

customer_address=Moor Building 35274 State ST Fremont. U.S.A&

customer_ip=10.10.10.2

Merchant unsuccessful debit callback

id=1f34f446-fc45-11ec-a50f-0242ac120004&

order_number=order-1234&

order_amount=3.01&

order_currency=QAR&

order_description=bloodline&

order_status=decline&

type=debit&status=fail&

card=411111****1111&

card_expiration_date=12/2022&

reason=Declined by processing.&

date=2022-07-05+09:30:35&

hash=7f15d178e9b2c8507dea57f8ed1efddb9573fa6b&

customer_name=D D&

[email protected]&

customer_country=QA&

customer_state=California&

customer_city=Doha&

customer_address=Moor Building 35274 State ST Fremont. U.S.A&

customer_ip=10.10.10.2

Merchant unsuccessful refund callback

id=ba290c62-fc45-11ec-9e91-0242ac120004&

order_number=order-1234&

order_amount=3.01&

order_currency=QAR&

order_description=bloodline&

order_status=decline&

type=refund&

status=fail&

card=411111****1111&

card_expiration_date=12/2022&

reason=Declined by processing.&

schedule_id=4e46866c-f84b-11ec-8b4c-0242ac120007&recurring_init_trans_id=ba290c62-fc45-11ec-9e91-0242ac120004&recurring_token=ba51844e-fc45-11ec-932c-0242ac120004&

date=2022-07-05+09:38:00&

hash=bcd78ff8b8e6b75aa1743910641217be6edc3a43&

customer_name=D D&

[email protected]&customer_country=QA&

customer_state=California&

customer_city=Doha&

customer_address=Moor Building 35274 State ST Fremont. U.S.A&

customer_ip=10.10.10.2

Merchant unsuccessful transfer callback

id=1f34f446-fc45-11ec-a50f-0242ac120004&

order_number=order-1234&

order_amount=3.01&

order_currency=QAR&

order_description=bloodline&

order_status=decline&

type=transfer&

status=fail&

card=411111****1111&

card_expiration_date=12/2022&

payee_card=422222****2222&

date=2022-07-05+09:22:09&

hash=6d8d440e25bdfc5288616ce567496948d2562852&

customer_name=D D&

[email protected]&

customer_country=QA&

customer_state=California&

customer_city=Doha&

customer_address=Moor Building 35275&

customer_ip=10.10.10.2&

payee_name=D D&

[email protected]&

payee_country=QA&

payee_state=California&

payee_city=Doha&

payee_address=Moor Building 35274 State ST Fremont. U.S.A&

vat_amount=0.3

CAPTURE

The CAPTURE request is executed after a successful AUTH, finalizing the payment by transferring the authorized funds from the customer’s account.

It is now possible to perform the CAPTURE operation via API request, whereas previously this action was available only through the Admin UI.

CAPTURE request

/api/v1/payment/capture

Request parameters

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

merchant_key | String | Required | Key for Merchant identification Example: xxxxx-xxxxx-xxxxx |

payment_id | String | Required Up to 255 characters | Payment ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

amount | Float | Required Not blank Greater then 0 0-9 max: 255 | Format depends on currency. Send Integer type value for currencies with zero-exponent. Example: 1000 Send Float type value for currencies with exponents 2, 3, 4. Format for 2-exponent currencies: XX.XX Example: 100.99 Pay attention that currencies 'UGX', 'JPY', 'KRW', 'CLP' must be send in the format XX.XX, with the zeros after comma. Example: 100.00 Format for 3-exponent currencies: XXX.XXX Example: 100.999. Format for 4-exponent currencies: XXX.XXXX Example: 100.9999 |

hash | String | Required | Special signature to validate your request to Payment Platform Addition in Signature section. Must be SHA1 of MD5 encoded string (uppercased): payment_id + amount + merchant_pass |

Request example

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/payment/capture' \

--header 'Content-Type: application/json' \

--data-raw '{

"merchant_key":"xxxxx-xxxxx-xxxxx",

"payment_id":"63c781cc-de3d-11eb-a1f1-0242ac130006",

"amount":"{{amount_hash}}"

"hash":"{{operation_hash}}"

}'

Response Parameters

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

payment_id | String | Required Up to 255 characters | Payment ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

status | String | Required | Capture request result Example: settled |

date | String | Required Format: YYYY-MM-DD hh:mm:ss | Transaction date Example: 2020-08-05 07:41:10 |

trans_status | String | Required | Transaction status Example: SUCCESS |

Response example

{

"status": "settled",

"payment_id": "63c781cc-de3d-11eb-a1f1-0242ac130006",

"date": "2020-08-05 07:41:10",

"trans_status": "SUCCESS"

}

Recurring

Recurring payments are commonly used to create new transactions based on already stored cardholder information from previous operations. This request is sent by POST in JSON format.

RECURRING request

/api/v1/payment/recurring

Request Parameters

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

merchant_key | String | Required | Key for Merchant identification Example: xxxxx-xxxxx-xxxxx |

recurring_init_trans_id | String | Required | Transaction ID of the primary transaction in the Payment Platform Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

recurring_token | String | Required | Recurring token Example: 9a2f-0242c0a87002 |

schedule_id | String | Optional | Schedule ID for recurring payments |

hash | String | Required | Special signature to validate your request to Payment Platform Addition in Signature section Must be SHA1 of MD5 encoded string (uppercased): recurring_init_trans_id + recurring_token + order.number + order.amount + order.description + merchant_pass |

| order | Object | ||

number | String | Required Not blank max: 255 [a-zA-Z0-9-] | Order ID Example: order-1234 |

amount | Float | Required Not blank Greater then 0 0-9 max: 255 | Format depends on currency. Send Integer type value for currencies with zero-exponent. Example: 1000 Send Float type value for currencies with exponents 2, 3, 4. Format for 2-exponent currencies: XX.XX Example: 100.99 Pay attention that currencies 'UGX', 'JPY', 'KRW', 'CLP' must be send in the format XX.XX, with the zeros after comma. Example: 100.00 Format for 3-exponent currencies: XXX.XXX Example: 100.999. Format for 4-exponent currencies: XXX.XXXX Example: 100.9999 |

description | String | Required min: 2 max: 1024 [a-zA-Z0-9!"#$%&'()*+,./:;&@] | Product name Example: Very important gift - # 9 |

Response Parameters

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

status | String | Required | Payment status Example: SETTLED, PENDING, DECLINE |

reason | String | Optional | Decline reason translation for unsuccessful payment. It displays only if the transaction is unsuccessful Example: The operation was rejected. Please contact the site support |

payment_id | String | Required Up to 255 characters | Transaction ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

date | String | Required Format: YYYY-MM-DD hh:mm:ss | Transaction date Example: 2020-08-05 07:41:10 |

schedule_id | String | Optional | Schedule ID for recurring payments |

| order | Object | ||

number | String | Required max: 255 | Order ID Example: order-1234 |

amount | String | Required Format: XX.XX | Product price (currency will be defined by the first payment) Example: 0.19 |

currency | String | Required 3 characters | Currency Example: QAR |

description | String | Required max: 1024 | Product name Example: Very important gift - # 9 |

Example Request

Recurring (settled)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/payment/recurring' \

--header 'Content-Type: application/json' \

--data-raw '{

"merchant_key":"xxxxx-xxxxx-xxxxx",

"order":{

"number":"order-1234",

"amount": "0.19",

"description":"very important gift"

},

"customer": {

"name": "John Doe",

"email": "[email protected]"

},

"recurring_init_trans_id":"dc66cdd8-d702-11ea-9a2f-0242c0a87002",

"recurring_token":"9a2f-0242c0a87002",

"schedule_id":"57fddecf-17b9-4d38-9320-a670f0c29ec0",

"hash":"{{session_hash}}"

}'

Recurring (declined)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/payment/recurring' \

--header 'Content-Type: application/json' \

--data-raw '{

"payment_id": "1f34f446-fc45-11ec-a50f-0242ac120004",

"date": "2022-07-05 09:30:34",

"status": "decline",

"reason": "Declined by processing.",

"order": {

"number": "order-1234",

"amount": "3.01",

"currency": "QAR",

"description": "bloodline"

},

"customer": {

"name": "John Doe",

"email": "[email protected]"

}

}'

Example Response

Status Settled

{

"status": "settled",

"payment_id": "dc66cdd8-d702-11ea-9a2f-0242c0a87002",

"date": "2020-08-05 07:41:10",

"schedule_id":"57fddecf-17b9-4d38-9320-a670f0c29ec0",

"order": {

"number": "order-1234",

"amount": "0.19",

"currency": "QAR",

"description": "very important gift"

}

}

Status Declined

{

"status": "declined",

"reason": "declined by processing",

"payment_id": "dc66cdd8-d702-11ea-9a2f-0242c0a87002",

"schedule_id":"57fddecf-17b9-4d38-9320-a670f0c29ec0",

"date": "2020-08-05 07:41:10",

"order": {

"number": "order-1234",

"amount": "0.19",

"currency": "QAR",

"description": "very important gift"

}

}

Retry

RETRY request is used to retry funds charging for secondary recurring payments in case of soft decline.

This action creates RETRY transaction and can cause payment final status changing.

This request is sent by POST in JSON format.

RETRY request

/api/v1/payment/retry

Request parameters

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

merchant_key | String | Required | Key for Merchant identification Example: xxxxx-xxxxx-xxxxx |

payment_id | String | Required Up to 255 characters | Payment ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

hash | String | Required | Special signature to validate your request to Payment Platform Addition in Signature section. Must be SHA1 of MD5 encoded string (uppercased): payment_id + merchant_pass |

Request example

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/payment/retry' \

--header 'Content-Type: application/json' \

--data-raw '{

"merchant_key":"xxxxx-xxxxx-xxxxx",

"payment_id":"63c781cc-de3d-11eb-a1f1-0242ac130006",

"hash":"{{operation_hash}}"

}'

Response Parameters

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

payment_id | String | Required Up to 255 characters | Payment ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

result | String | Required | Retry request result Example: accepted |

Response example

{

"payment_id": "63c781cc-de3d-11eb-a1f1-0242ac130006",

"result": "accepted"

}

Get transaction status

This request is sent by POST in JSON format.

To get order status you can use one the identifiers:

• payment_id – transaction ID in the Payment Platform

• order_id – merchant’s transaction ID

/api/v1/payment/status

GET_TRANS_STATUS by payment_id

Note: The response logic for a status request depends on the Cascading Context for Get Status setting in Cofiguration --> Protocol Mappings section. If enabled, the system returns the status of the most recently created payment within the cascade (i.e., the payment with the latest creation date), rather than the payment specified in the request.

Request Parameters by payment_id

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

merchant_key | String | Required | Key for Merchant identification Example: xxxxx-xxxxx-xxxxx |

payment_id | String | Required Up to 255 characters | Payment ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

hash | String | Required | Special signature to validate your request to Payment Platform Addition in Signature section. Must be SHA1 of MD5 encoded string (uppercased): payment_id + merchant_pass |

Response Parameters by payment_id

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

payment_id | String | Required Up to 255 characters | Payment ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

date | String | Required Format: YYYY-MM-DD hh:mm:ss | Transaction date Example: 2020-08-05 07:41:10 |

status | String | Required | Payment status: prepare, settled, pending, 3ds, redirect, decline, refund, reversal, void, chargeback Example: settled |

reason | String | Optional | Decline reason translation for unsuccessful payment. It displays only if the transaction is unsuccessful Example: The operation was rejected. Please contact the site support |

recurring_token | String | Optional | Recurring token (provided if recurring was initialized) Example: e5f60b35485e |

shedule_id | String | Optional | Schedule ID for recurring payments. Only for purchase operation Example: 57fddecf-17b9-4d38-9320-a670f0c29ec0 |

| order | Object | ||

number | String | Required Up to 255 characters | Order ID Example: order-1234 |

amount | String | Required Format: XX.XX | Product price Example: 0.19 |

currency | String | Required Up to 3 characters | Currency Example: QAR |

description | String | Required Up to 1024 characters | Product name Example: Very important gift |

| customer | Object | ||

name | String | Required | Customer's name Example: John Doe |

email | String | Required | Customer's email address Example: [email protected] |

digital_wallet | String | Optional | Wallet provider: googlepay, applepay. It returns if digital wallets were used for card payment creation. Example: googlepay |

Example Request

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/payment/status' \

--header 'Content-Type: application/json' \

--data-raw '{

"merchant_key":"xxxxx-xxxxx-xxxxx",

"payment_id":"63c781cc-de3d-11eb-a1f1-0242ac130006",

"hash":"{{operation_hash}}"

}

'

Example Response

Status Settled

{

"payment_id": "24f7401c-fc47-11ec-8d07-0242ac120015",

"date": "2022-07-05 09:45:03",

"status": "settled",

"recurring_token": "e5f60b35485e",

"shedule_id ": "57fddecf-17b9-4d38-9320-a670f0c29ec0",

"digital_wallet": "googlepay",

"order": {

"number": "f0a51dfa-fc43-11ec-8128-0242ac120004-1",

"amount": "3.01",

"currency": "QAR",

"description": "bloodline"

},

"customer": {

"name": "John Doe",

"email": "[email protected]"

}

}

Status Decline

{

"payment_id": "03e46e96-de42-11eb-aea7-0242ac140002",

"date": "2021-07-06 10:07:47",

"status": "decline",

"reason": "Declined by processing",

"digital_wallet": "googlepay",

"order": {

"number": "order-1234",

"amount": "0.19",

"currency": "QAR",

"description": "Important gift"

},

"customer": {

"name": "John Doe",

"email": "[email protected]"

}

}

GET_TRANS_STATUS by order_id

Use this request to get the status of the most recent transaction in the order's transaction subsequence.

It is recommended to send an unique order number (the order.number parameter) in the Authorization request. That way, it will be easier to uniquely identify the payment by order_id. This is especially important if cascading is configured. In this case, several intermediate transactions could be created within one payment.

Request Parameters by order_id

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

merchant_key | String | Required | Key for Merchant identification Example: xxxxx-xxxxx-xxxxx |

order_id | String | Required Up to 255 characters | Merchant’s Order Number Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

hash | String | Required | Special signature to validate your request to Payment Platform Addition in Signature section. Must be SHA1 of MD5 encoded string (uppercased): order_id + merchant_pass |

Response Parameters by order_id

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

payment_id | String | Required Up to 255 characters | Transaction ID in Payment Platform Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

date | String | Required Format: YYYY-MM-DD hh:mm:ss | Transaction date Example: 2020-08-05 07:41:10 |

status | String | Required Up to 20 characters | Payment status: prepare, settled, pending, 3ds, redirect, decline, refund, reversal, void, chargeback Example: settled |

reason | String | Optional Up to 1024 characters | Decline reason translation for unsuccessful payment. It displays only if the transaction is unsuccessful Example: The operation was rejected. Please contact the site support |

recurring_token | String | Optional | Recurring token (provided if recurring was initialized) Example: e5f60b35485e |

shedule_id | String | Optional | Schedule ID for recurring payments. Only for purchase operation Example: 57fddecf-17b9-4d38-9320-a670f0c29ec0 |

| order | Object | ||

number | String | Required Up to 255 characters | Merchant’s Order ID Example: order-1234 |

amount | String | Required Format: XX.XX | Product price (currency will be defined by the first payment) Example: 0.19 |

currency | String | Required Up to 3 characters | Currency Example: QAR |

description | String | Required Up to 1024 characters | Product name or other additional information Example: Very important gift |

| customer | Object | ||

name | String | Required | Customer's name Example: John Doe |

email | String | Required | Customer's email address Example: [email protected] |

digital_wallet | String | Optional | Wallet provider: googlepay, applepay. It is returned if digital wallets were used for card payment Example: googlepay |

Example Request

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/payment/status' \

--header 'Content-Type: application/json' \

--data-raw '{

"merchant_key":"xxxxx-xxxxx-xxxxx",

"order_id":"63c781cc-de3d-11eb-a1f1-0242ac130006",

"hash":"{{operation_hash}}"

}

'

Example Response

Status Settled

{

"payment_id": "24f7401c-fc47-11ec-8d07-0242ac120015",

"date": "2022-07-05 09:45:03",

"status": "settled",

"recurring_token": "e5f60b35485e",

"shedule_id ": "57fddecf-17b9-4d38-9320-a670f0c29ec0",

"digital_wallet": "googlepay",

"order": {

"number": "f0a51dfa-fc43-11ec-8128-0242ac120004-1",

"amount": "3.01",

"currency": "QAR",

"description": "bloodline"

},

"customer": {

"name": "John Doe",

"email": "[email protected]"

}

}

Status Decline

{

"payment_id": "03e46e96-de42-11eb-aea7-0242ac140002",

"date": "2021-07-06 10:07:47",

"status": "decline",

"reason": "Declined by processing",

"digital_wallet": "googlepay",

"order": {

"number": "order-1234",

"amount": "0.19",

"currency": "QAR",

"description": "Important gift"

},

"customer": {

"name": "John Doe",

"email": "[email protected]"

}

}

Refund

To make refund you can use Refund request. Use payment public ID from Payment Platform in the request.

This request is sent by POST in JSON format.

Refund request

/api/v1/payment/refund

Request Parameters

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

merchant_key | String | Required | Key for Merchant identification Example: xxxxx-xxxxx-xxxxx |

payment_id | String | Required Up to 255 characters | Payment ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

amount | String | Required Format: XX.XX, without leading zeroes | Amount to refund. It is required for particular refund. Example: 0.19 |

hash | String | Required | Special signature to validate your request to Payment Platform Addition in Signature section. Must be SHA1 of MD5 encoded string (uppercased): payment.id + amount + merchant.pass |

Response Parameters

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

payment_id | String | Required Up to 255 characters | Transaction ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

result | String | Required | Refund request result Example: accepted |

Example Request

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/payment/refund' \

--header 'Content-Type: application/json' \

--data-raw '{

"merchant_key":"xxxxx-xxxxx-xxxxx",

"payment_id":"63c781cc-de3d-11eb-a1f1-0242ac130006",

"amount":"0.10",

"hash":"{{operation_hash}}"

}

'

Example Response: Refund request accepted

{

"payment_id": "63c781cc-de3d-11eb-a1f1-0242ac130006",

"result": "accepted"

}

Void

To make a void for an operation which was performed the same financial day you can use Void request.

The Void request is allowed for the payments in SETTLED status only.

Use payment public ID from Payment Platform in the request.

Void request

/api/v1/payment/void

Request Parameters

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

merchant_key | String | Required | Key for Merchant identification Example: xxxxx-xxxxx-xxxxx |

payment_id | String | Required Up to 255 characters | Payment ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

hash | String | Required | Special signature to validate your request to Payment Platform Addition in Signature section. Must be SHA1 of MD5 encoded string (uppercased): payment.id + merchant.pass |

Response Parameters

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

status | String | Required | Payment status Example: VOID / SETTLED |

payment_id | String | Required Up to 255 characters | Transaction ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

date | String | Required Format: YYYY-MM-DD hh:mm:ss | Transaction date Example: 2020-08-05 07:41:10 |

reason | String | Optional | Decline or error reason (for "sale", "void "and "refund" operation types). It displays only if the transaction has FAIL status Example: The operation was rejected. Please contact the site support |

| order | Object | ||

number | String | Required | Order ID Example: order-1234 |

amount | String | Required | Product price Example: 0.19 |

currency | String | Required Up to 3 characters | Currency Example: QAR |

description | String | Required Up to 1024 characters | Product name Example: Very important gift |

Example Request

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/payment/void' \

--header 'Content-Type: application/json' \

--data-raw '{

"merchant_key":"xxxxx-xxxxx-xxxxx",

"payment_id":"63c781cc-de3d-11eb-a1f1-0242ac130006",

"hash":"{{operation_hash}}"

}

'

Example Response: Void successful

{

"status": "SUCCESS",

"payment_status": "void",

"payment_id": "dc66cdd8-d702-11ea-9a2f-0242c0a87002",

"date": "2020-08-05 07:41:10",

"order": {

"number": "order-1234",

"amount": "0.19",

"currency": "QAR",

"description": "very important gift"

}

}

Example Response: Void failed

{

"status": "FAIL",

"payment_status": "settled",

"payment_id": "dc66cdd8-d702-11ea-9a2f-0242c0a87002",

"date": "2020-08-05 07:41:10",

"reason": "Declined by processing",

"order": {

"number": "order-1234",

"amount": "0.19",

"currency": "QAR",

"description": "very important gift"

}

}

Signature

Sign is signature rule used either to validate your requests to payment platform or to validate callback from payment platform to your system.

Authentication Signature

It must be SHA1 of MD5 encoded string and calculated by the formula below:

*sha1(md5(strtoupper(id.order.amount.currency.description.PASSWORD)))

// Use the CryptoJSvar

Example for JS

var to_md5 = order.number + order.amount + order.currency + order.description + merchant.pass;

// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Get Transaction Status Signature (by payment_id)

It must be SHA1 of MD5 encoded string and calculated by the formula below:

hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

*sha1(md5(strtoupper))

// Use the CryptoJSvar

Example for JS

var to_md5 = payment.id + merchant.pass;

// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Get Transaction Status Signature (by order_id)

It must be SHA1 of MD5 encoded string and calculated by the formula below:

hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

*sha1(md5(strtoupper))

// Use the CryptoJSvar

Example for JS

var to_md5 = order.id + merchant.pass;

// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Refund Signature

It must be SHA1 of MD5 encoded string and calculated by the formula below:

hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString()); *sha1(md5(strtoupper))

// Use the CryptoJSvar

Example for JS

var to_md5 = payment.id + amount + merchant.pass;

// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Void Signature

It must be SHA1 of MD5 encoded string and calculated by the formula below:

hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString()); *sha1(md5(strtoupper))

// Use the CryptoJSvar

Example for JS

var to_md5 = payment.id + merchant.pass;

// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Recurring Signature

It must be SHA1 of MD5 encoded string and calculated by the formula below:

*sha1(md5(strtoupper(recurring_init_trans_id.recurring_token.order_id.amount.description.merchant.pass)))

// Use the CryptoJS

Example for JS

var to_md5 = recurring_init_trans_id + recurring_token + order.number + order.amount + order.description + merchant.pass;

// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Signature for return

It must be SHA1 of MD5 encoded string and calculated by the formula below:

hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString()); *sha1(md5(strtoupper(payment_public_id.order_id.amount.currency.description.PASSWORD)))

Example for JS

var to_md5 = payment_public_id + order.number + order.amount + order.currency + order.description + merchant.pass;

// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Signature for capture

It must be SHA1 of MD5 encoded string and calculated by the formula below:

hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString()); *sha1(md5(strtoupper))

// Use the CryptoJSvar

Example for JS

var to_md5 = payment.id + amount + merchant.pass;

// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Callback Signature

It must be SHA1 of MD5 encoded string and calculated by the formula below:

hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString()); *sha1(md5(strtoupper(payment_public_id.order_id.amount.currency.description.PASSWORD)))

Example for JS

var to_md5 = payment_public_id + order.number + order.amount + order.currency + order.description + merchant.pass;

// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Testing

You can test your integration. To do the test you need to perform the actions with the API using (in test mode). For instance, send the request and receive the response with a link on the Checkout page.

To mark your transactions as test in the system, you should use Merchant Test Key as value of the merchant_key parameter. You can contact your administrator to make sure that you have the necessary settings to work with test transactions.

Credit Card

Use the following test data to emulate the different scenarios.

Scenario: SUCCESS payment

Card data:

Card number 4111 1111 1111 1111

Expiry Date 01/38

CVV2 any 3 digits

⚠️ Use that card data to create recurring payments and get a recurring token for the initial recurring. Testing recurring payments does not work with other test cards.

Result: customer is redirected to the "success_URL"

Scenario: FAILED payment (decline)

Card data:

Card number 4111 1111 1111 1111

Expiry Date 02/38

CVV2 any 3 digits

Result: customer gets an error message: Declined by processing.

Scenario: SUCCESS 3DS payment

Card data:

Card number 4111 1111 1111 1111

Expiry Date 05/38

CVV2 any 3 digits

Result: customer is redirected to the "success_URL" after 3DS verification

Scenario: FAILED 3DS payment

Card data:

Card number 4111 1111 1111 1111

Expiry Date 06/38

CVV2 any 3 digits

Result: customer gets unsuccessful sale after 3DS verification

Scenario: FAILED payment (Luhn algorithm)

Card data:

Card number 1111 2222 3333 4444

Expiry Date 01/38

CVV2 any 3 digits

Result: customer gets an error message: Bad Request. Brand of card does not support.

Debit Card NAPS

Use the following test data to emulate the different scenarios.

For Card

Card data:

Card number 4215375500883243

Expiry Date 06/2028

CVV2 123

Pin 1324

For Himyan

Card number 6399502253289053

Expiry Date 07/2029

CVV2 186

Pin 123456

OM Wallet

Use the following test data to emulate the different scenarios.

Wallet data:

Wallet number +97487778777

Mpin 1212

OTP 1234